Foundations of Finance: A Look at Responsible Investing Through Screens and Integration

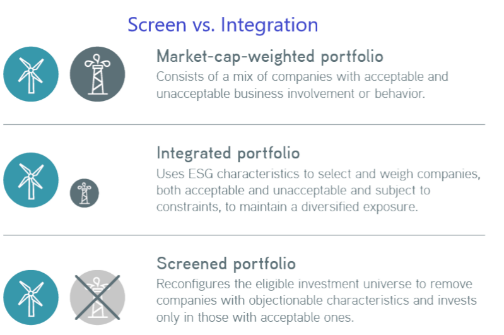

Screens and integration are the designated tools of sustainable portfolio construction. While screens involve setting conditional, unweighted limitations on environmental, social, or governance-specific securities, integration (also known as tilt) is an unrestricted, reweighted reflection of securities based on ESG qualifications. Many factors and metrics come into play when responsible investors look to build their portfolios, but screens and integration lay the foundation for setting ESG investment priorities. We will now explore how screens and integration are used and the impact they can have on sustainable investing— both separately and together.

Setting a Screen

Just as filters are used to separate the impurities from drinking water, a screen divides an investment universe to excluded securities that fail to meet a set of ESG requirements. In order to create a screen, investors can apply exact ESG metrics and their desired thresholds— such as companies with no fossil-fuel reserves, less than 20% of revenues from selling alcohol, and more than two female board of directors— to make their list of potential securities as large as possible within the specified boundaries. Applying such limitations will allow you to build a portfolio that only includes the qualities you want, but doesn’t indicate the degree to which each are present. This means your portfolio will only include companies that meet, for example, the desired fossil-fuel/alcohol sales/board of director requirements, but will not specify how much of each value is represented within these qualified securities.

Integrated Investing

Whereas screens are formed like the water filtration effect, integration comes to fruition in the same manner as a well-organized wine cellar— which painstakingly displays each bottle in its collection by flavor, region, and price. Integration gives investors the ability to explore the degrees to which each security includes specific metrics and categorizes them based on the overall potency of the combined metrics. As a quantitative measure of data, integration is created by rolling a series of ESG metrics into a single entity and evaluating how each performs when compared to other securities. This approach to ESG investing gives you an idea of overall security performance within a universe based on relativity as opposed to absolutes that come with the screen technique.

The Double Play

Building a portfolio using either screening or integration can help you align your responsible investing goals, but so can combining the two methods. The screen-integration hybrid technique allows you to exclude securities from an investment universe AND give them weight based on ESG criteria. This hybrid method combines elements of quantitative and qualitative analysis that offers a more precise list of eligible securities, but also greatly reduces your field of options.

The Bottom Line

Portfolio construction for responsible investing requires the use of techniques that screen and/or integrate securities. Screens place emphasis on ESG criteria over benchmarks, and integration favors benchmarks while offering a more comprehensive range of securities from which to choose. Whether applied individually or together, both methods can lead to financial prosperity when creating a portfolio that matches your sustainable investment objectives.